New Credit Cards

In 2000 I applied for my first credit card. It was an MBNA card with a Blackhawks logo and a $750 credit limit. In the decade that has passed MBNA has been bought out by Bank of America, my credit limit has increased over 3,000% and Beth and I have put over $100K on that card. (Don’t worry… we are disciplined and have never paid interest on it because we always pay it off in full. In fact, because of our reward program, we have made close to $1000.)

Well after 10 years with MBNA / Bank of America, the time has come for us to move on. We had been happy with our card up until the last couple years. It probably started with the Financial Crisis as I became increasingly uneasy with how Bank of America had behaved (See this article from CNN Money and this article from Bloomberg). Then I saw this interview with Jim Wallis on The Daily Show where he talked about “divorcing your bank” to show your displeasure with how your financial institute was morally behaving. It made sense, but we were pretty happy with Bank of America.

That changed a few months ago when we had to challenge a charge on our credit card. Basically we were schemed by a junk yard in Nashville. Hilltop Auto Salvage sold us a defective engine and then despite following their return policy, they charged us over $400 in restocking fees. I worked with the claims department at BofA from the very beginning and followed their advice. Unfortunately it was a case of the right hand not knowing what the left hand was doing and after nearly 6 months of misinformation, bad advise, poor correspondence and contradictory reports, our claim got completely screwed up. We were awarded the money and then 4 months later they charged us for it again. The worst part was that I couldn’t get a straight answer. I followed their advice to the letter, but each person I talked with contradicted the first. Basically I was told I was denied because I followed the process they recommended.

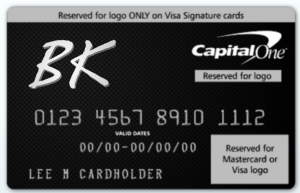

After that SNAFU we were ready to move on. We did our research and realized that if we switched to Capital One we could receive more cash back and not have to worry about paying “International Fees” (something very important for us as look to make our move). They were a pleasure to deal with and everyone I asked said they have had never had a problem with them. Plus, I think it is pretty nifty that you can design your own card.

To no one’s surprise, my card has been customized with my initials and a carbon fiber background:

Equally unsurprising, Beth went with a picture of giraffes on her card:

We would like to thank Luca Galuzzi who generously allowed us to use his picture from Ithala Game Reserve as the background for Beth’s card. Check out his website, he has some incredible shots: http://www.galuzzi.it/

What started as a bad taste in our mouth with Bank of America turned into a pain in the butt. Thankfully, in the end we have ended up with what we feel is a better option…. plus we have pretty cool plastic now.

Thanks for this post. My card currently charges like 5% for international purchases, which isn’t going to fly over the next 5-7 years in Canada. Currently investigating Capital One.

We have “excellent credit” so we were able to apply for their premium rewards card. No annual fees, 3% cashback on gas and groceries and 1% cash back on everything else. Here is the specific card we have:

http://www.capitalone.com/creditcards/products/details/?sol=11238&tc=1&credit=0&linkid=WWW_0608_CARD_TGUNS01_CCBRWPOP_C3_02_T_CP23801EW